Introduction

In the fast-paced and dynamic global of finance, buyers and buyers are constantly looking for gear and techniques to navigate the complicated internet of markets. One such powerful device is technical evaluation, a method that has been used for decades to analyze and interpret price charts. In this comprehensive guide, we can delve into the principles of technical evaluation, exploring its principles, key principles, and the function it plays in making informed funding choices.

Understanding Technical Analysis

Technical analysis is a way used to evaluate and expect destiny price moves of economic assets primarily based on ancient fee facts and buying and selling extent. Unlike essential analysis, which makes a speciality of a organisation’s financial fitness and intrinsic fee, technical evaluation is based on the notion that ancient price moves and styles have a tendency to copy themselves. The number one assumption is that all applicable statistics is already reflected within the asset’s rate.

Key Principles of Technical Analysis

Price Discounts Everything:

According to technical evaluation, all facts, whether or not public or private, is already reflected in an asset’s charge. This precept implies that the present day market fee considers all elements influencing the asset.

Price Moves in Trends:

One of the foundational concepts of technical evaluation is that prices generally tend to transport in traits – upward, downward, or sideways. Identifying and information those traits is crucial for making knowledgeable buying and selling selections.

History Tends to Repeat Itself:

Technical analysts consider that ancient price moves and patterns often repeat, letting them expect capability destiny rate movements. This is based at the idea that human behavior, which drives marketplace movements, tends to remain steady.

Key Concepts in Technical Analysis

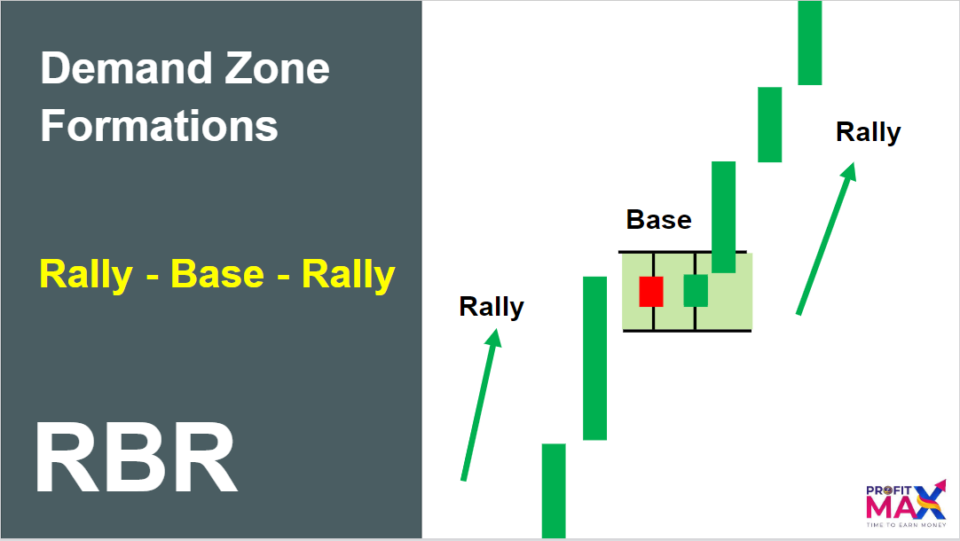

1. Candlestick Patterns:

Candlestick charts are famous amongst technical analysts for his or her ability to offer a visual representation of charge moves. Various candlestick styles, which includes doji, hammer, and engulfing patterns, provide insights into marketplace sentiment.

2. Chart Patterns:

Technical analysts have a look at chart patterns to discover ability fashion reversals or continuations. Common chart styles consist of head and shoulders, triangles, and flags, every supplying unique alerts about destiny price movements.

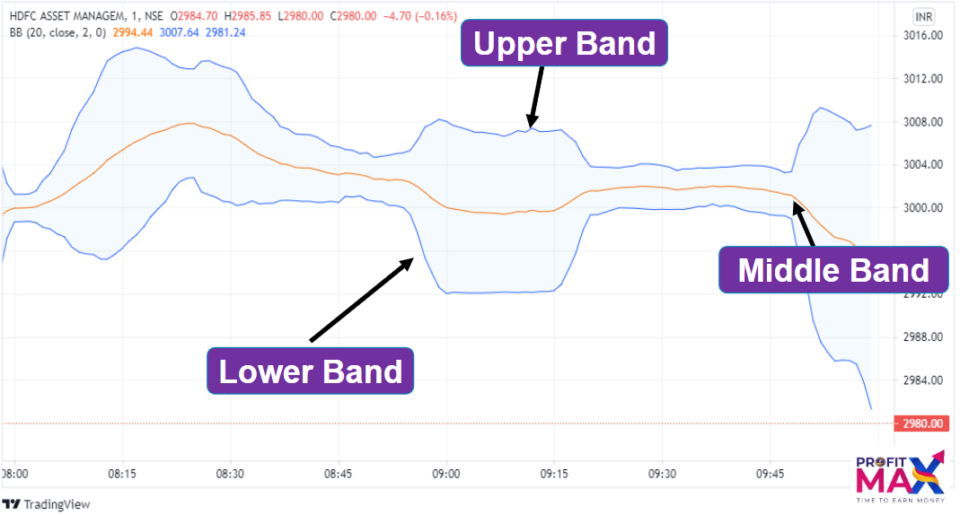

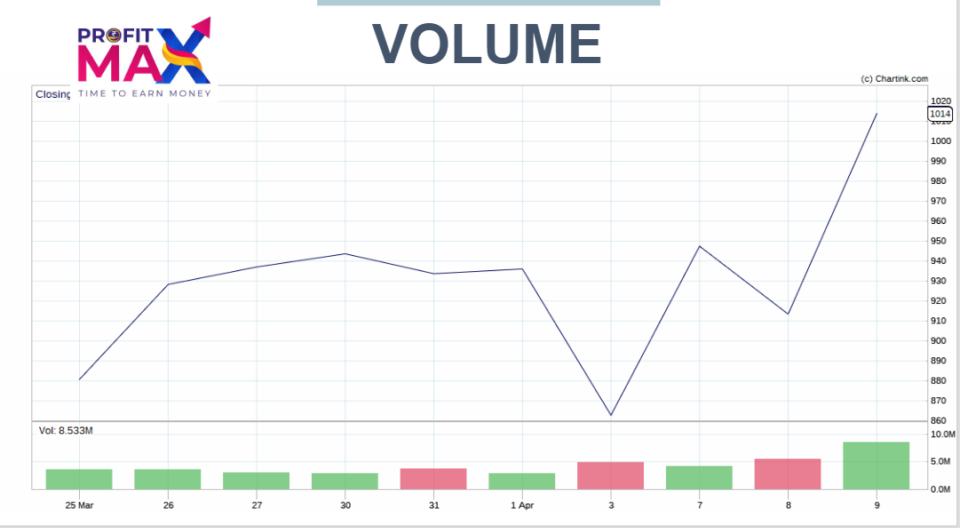

3. Indicators and Oscillators:

Technical signs and oscillators, together with transferring averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD), offer quantitative insights into an asset’s momentum, volatility, and electricity.

4. Trendlines:

Trendlines help perceive the course of a fashion and capability reversal points. Drawing trendlines on a price chart permits analysts to visualize key degrees of assist and resistance.

5. Support and Resistance:

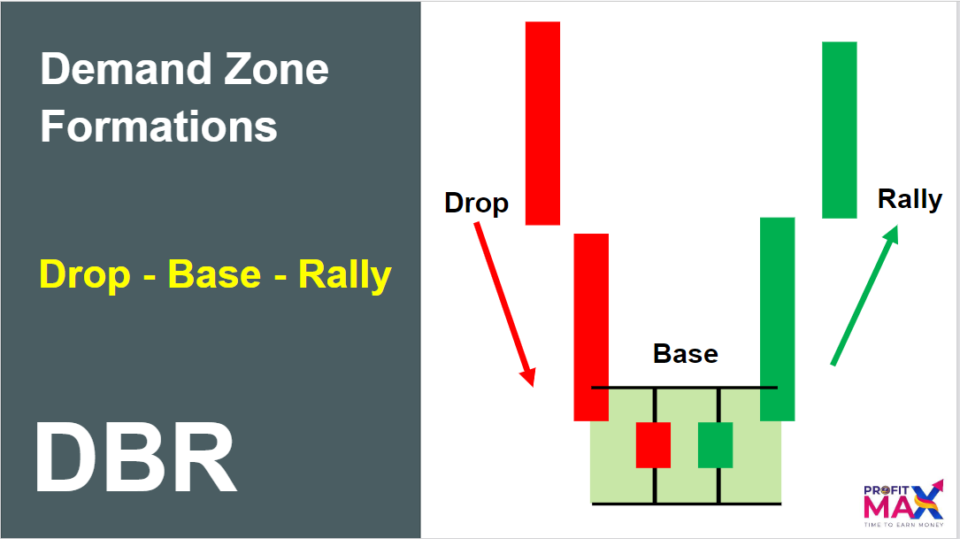

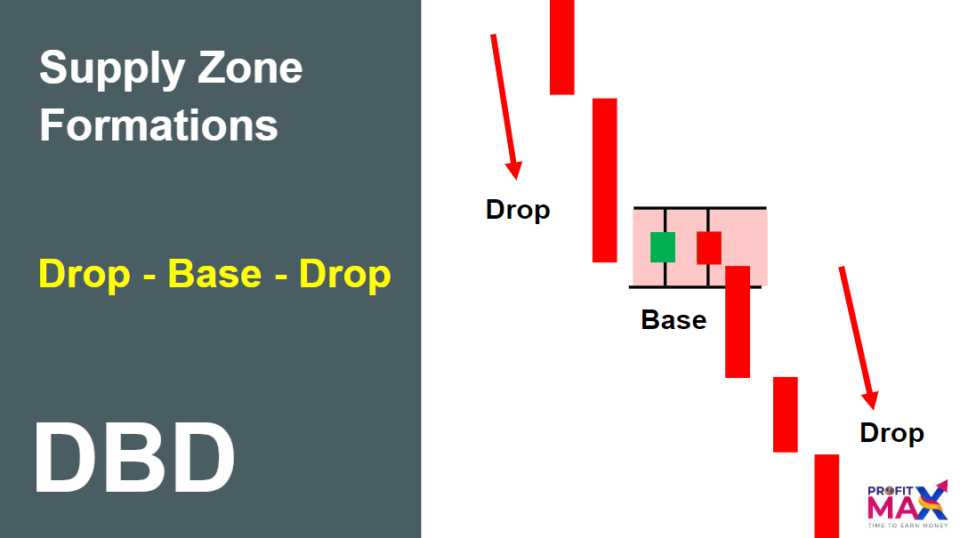

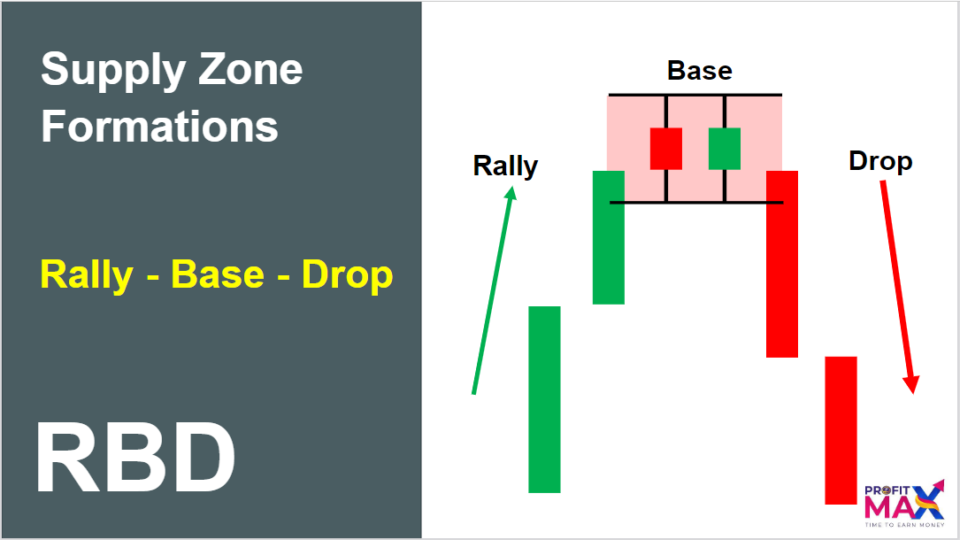

Support and resistance levels are key additives of technical evaluation. Support is a charge degree where a economic asset tends to stop falling, whilst resistance is a level in which it struggles to rise further. Identifying these degrees facilitates traders make choices approximately entry and go out points.

The Role of Technical Analysis in Decision-Making

1. Entry and Exit Points:

Technical analysis assists investors in determining top-rated entry and go out points for his or her trades. By figuring out trend reversals or breakouts, buyers can capitalize on potential price actions.

2. Risk Management: – Technical analysis plays a vital function in chance control. Through the identity of aid and resistance tiers, traders can set stop-loss orders to restriction capacity losses.

3. Market Timing: Timing is essential in financial markets, and technical evaluation aids in marketplace timing. Traders use technical signs to gauge the most excellent moments to enter or exit positions.

4. Portfolio Management: Investors and fund managers contain technical evaluation into their portfolio management strategies. By reading the general market traits, they are able to modify the allocation of assets to optimize returns.

Challenges and Criticisms

While technical analysis has verified effective for many traders, it is not with out its challenges and criticisms. Detractors argue that it is predicated on ancient facts and patterns that might not always repeat. Additionally, the subjective nature of interpretation and the capacity for false signals are demanding situations confronted via those depending solely on technical evaluation.

Conclusion

In conclusion, technical evaluation is a valuable device within the arsenal of traders and traders seeking to navigate the complexities of monetary markets. By understanding the key concepts, concepts, and the role it performs in selection-making, individuals can harness the energy of technical analysis to make greater informed and strategic funding choices. While now not a crystal ball, technical evaluation offers a lens through which marketplace participants can gain insights into ability destiny price moves and tendencies. As with any technique to market evaluation, combining technical analysis with different methodologies can beautify its effectiveness and make a contribution to a greater comprehensive knowledge of financial markets.