Introduction

The law of Demand and Supply is a fundamental concept of economics and a theory popularized by Adam Smith in 1776. The principles of supply and demand are effective in predicting market behavior. Whether an individual is a manufacturer or a consumer, the supply and demand equilibrium is relevant in daily market transactions. In this comprehensive guide, we can delve into the strategies and strategies hired by means of savvy market members, unraveling the nuanced moves of call for and deliver, and introducing the rally base rally, drop base rally, rally base drop, and drop base drop styles.

The Fundamentals of Demand and Supply in Stocks

Before we explore these patterns, let’s revisit the fundamentals of Demand and supply inside the context of the inventory marketplace.

Demand in Stock Market:

Demand represents the willingness of traders to buy a inventory. Positive business enterprise information, favorable sentiment, or expectancies of boom can power call for, main to an increase in stock expenses.

Supply in Stock Market:

Supply represents the quantity of a inventory that dealers are willing to provide. Negative news, Negative sentiment, or anticipation of poor overall performance can increase supply, ensuing in a decrease in stock price.

The Dance of Market Equilibrium:

Market equilibrium is finished while the amount of shares demanded equals the quantity supplied. Recognizing shifts in call for or deliver is critical for crafting powerful trading techniques.

Strategies for Navigating the Stock Market Dance

- Trend Following Strategy

Identifying and following developments is a cornerstone approach. An uptrend, driven by accelerated demand, pushes costs higher, at the same time as a downtrend, fueled through heightened deliver, results in rate declines. Traders using fashion-following strategies goal to trip those trends for profits.

- Support and Resistance Zones:

Support and resistance zones are important ranges wherein demand and deliver converge. Support prevents the stock from falling similarly, at the same time as resistance inhibits upward movement. Incorporating rally and drop styles into those zones enhances their effectiveness in making access and exit selections. Support and Resistance is used by most of the traders for Swing Trading and Long Term as well as Intraday Trading.

- Volume Analysis:

Volume, the number of stocks traded, is a robust indicator of the electricity in the back of charge moves. Volume evaluation allows gauge the conviction at the back of price actions during rally and drop patterns. Increased extent all through an uptrend signifies robust demand, even as excessive quantity at some stage in a downtrend suggests strong deliver.

- News and Sentiment Analysis:

News and sentiment notably influence call for and deliver. Positive information will increase call for, while terrible information augments supply. Staying knowledgeable approximately information trends allows traders to expect shifts in market sentiment.

- Candlestick Patterns:

Candlestick styles visually constitute the continuing battle among bulls (demand) and bears (deliver). Patterns like engulfing, doji, and hammer offer insights into ability reversals or continuations, such as rally base rally, drop base rally, rally base drop, and drop base drop patterns.

Note: To identify the best zones and maximize the profits we have indicator to use free of cost along with the course. To know more watch the video given below:

Incorporating Rally and Drop Patterns

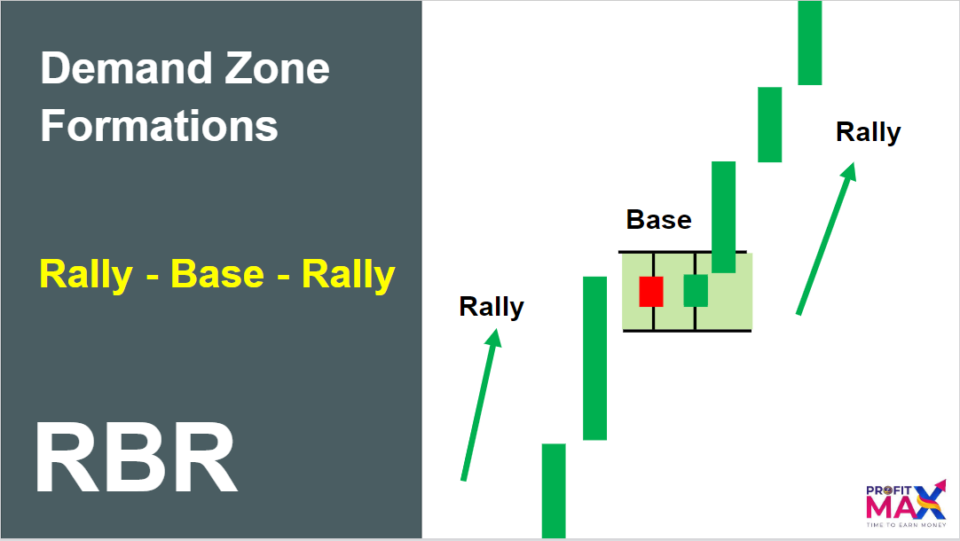

1. Rally Base Rally (RBR):

In the RBR sample, a robust rally is observed by way of a consolidation or base-building section, after which some other rally ensues. Traders perceive entry points at some point of the consolidation, looking ahead to a continuation of the upward trend.

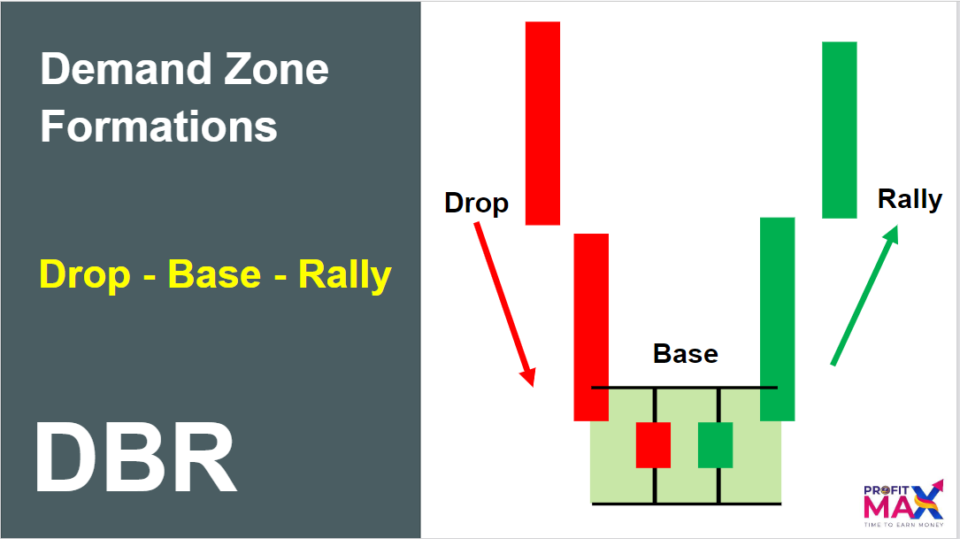

2. Drop Base Rally (DBR):

In the DBR sample, a sizable drop is followed via a duration of consolidation earlier than a rally begins. Traders search for opportunities to enter at some stage in the consolidation, looking ahead to a reversal of the downtrend.

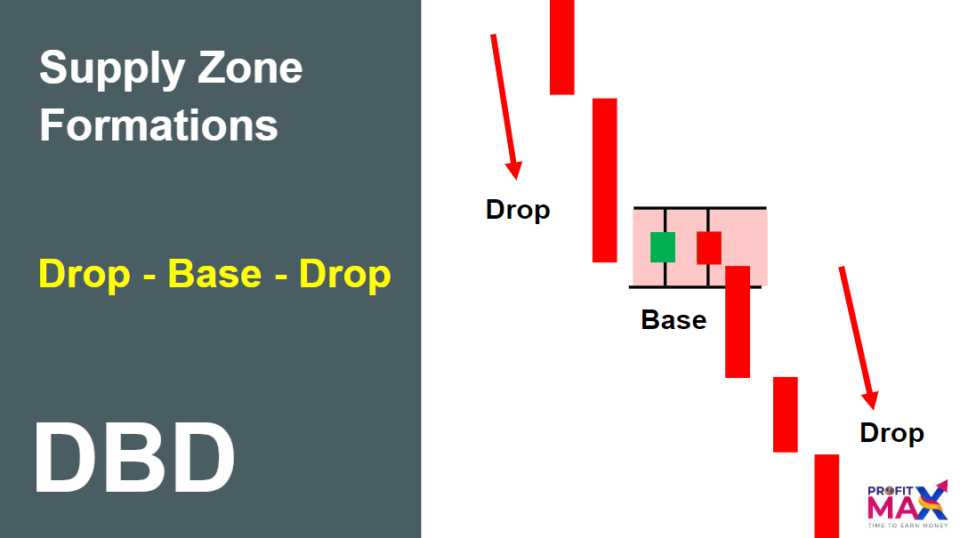

3. Drop Base Drop (DBD):

In the DBD sample, a drop is accompanied through a consolidation phase, after which some other drop takes place. Traders might also seek quick possibilities at some stage in the consolidation, watching for the downtrend to persist.

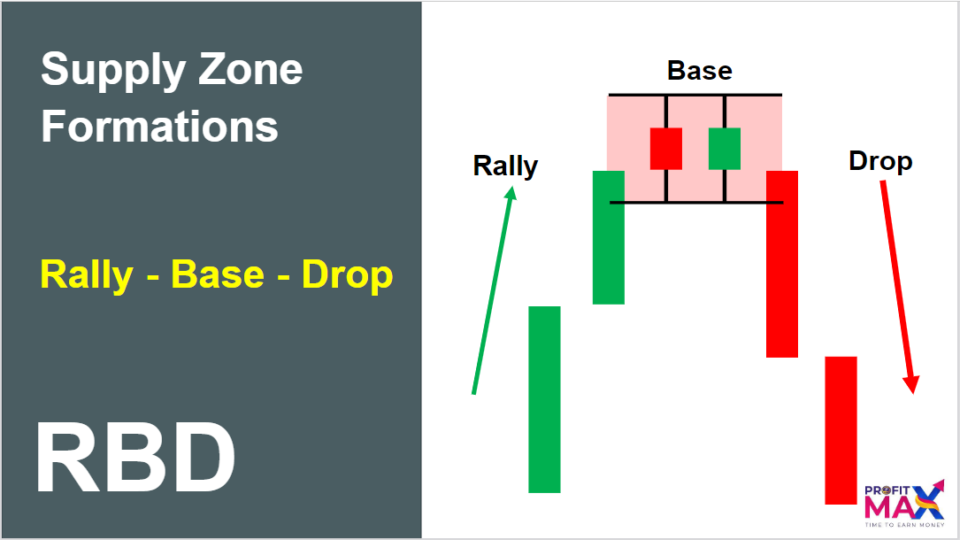

4. Rally Base Drop (RBD):

The RBD pattern involves a robust rally, a consolidation segment, after which a subsequent drop. Traders may also recollect quick positions at some stage in the consolidation, awaiting a shift to a downtrend.

Conclusion:

Before applying this strategy to your trading you should be able understand how candlestick are formed and how to identify the best pattern to enhance the chances of capturing the entire rally to maximise our profit during your trade be it swing trade, long term or intraday.

We have a dedicated indicator which can be applied on Tradingview.com to identify the best zones and maximize your profit with success ratio of 8 out of 10 (80%). To know more about the indicator feel free to contact us on 7722 08 2020 | Email : info@profitmaxacademy.com

You can also follow us on social media for regular updates related to stock market.