In the dynamic global of buying and selling, fulfillment hinges at the capacity to research and interpret market facts correctly. Traders appoint a number of equipment to make informed choices, with indicators playing a pivotal role in their method. In this complete guide, we’ll delve into the realm of buying and selling indicators, exploring the best ones that allow you to navigate the markets with precision and self assurance.

1. Moving Averages:

Moving averages are foundational indicators that clean out charge statistics, presenting a clearer image of the general trend. The Simple Moving Average (SMA) and the Exponential Moving Average (EMA) are widely used. SMAs offer a trustworthy average of expenses, whilst EMAs provide greater weight to current expenses, making them more responsive to market modifications.

2. Relative Strength Index (RSI):

The RSI is a momentum oscillator that measures the rate and alternate of rate actions. RSI values range from zero to one hundred, with readings above 70 indicating overbought situations and readings under 30 signaling oversold conditions. Traders use RSI to perceive capacity trend reversals and generate purchase or promote signals.

3. Moving Average Convergence Divergence (MACD):

MACD is a versatile indicator that mixes components of fashion-following and momentum indicators. It includes a MACD line and a signal line. When the MACD line crosses above the sign line, it generates a bullish sign, and vice versa. Additionally, the MACD histogram illustrates the difference between the MACD and signal line, supplying insight into the power of a trend.

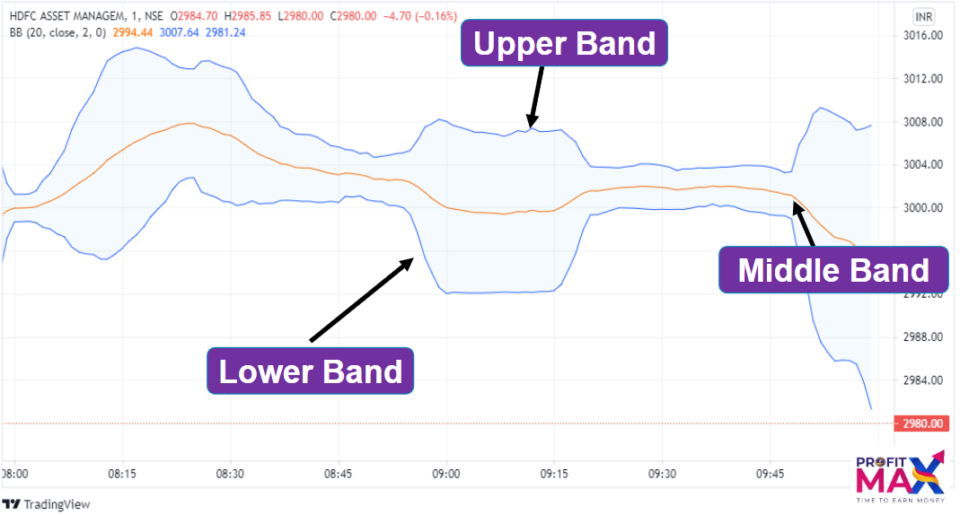

4. Bollinger Bands:

Bollinger Bands encompass a center band being an N-length easy transferring average and upper and decrease bands representing N well known deviations faraway from the moving common. The bands extend and agreement based on market volatility. Traders frequently search for fee touches close to the bands as ability reversal or continuation indicators.

5. Fibonacci Retracement:

Fibonacci retracement tiers are based on the mathematical relationships that occur in nature. Traders use these levels to identify potential reversal points in the marketplace. The key Fibonacci levels encompass 23.6%, 38.2%, 50%, sixty one.Eight%, and 78.6%. When blended with other signs, Fibonacci retracements beautify the precision of access and go out points.

6. Stochastic Oscillator:

The Stochastic Oscillator compares a protection’s final fee to its rate variety over a particular duration. It generates values among zero and one hundred, with readings above 80 indicating overbought conditions and readings underneath 20 signaling oversold situations. Traders often use Stochastic Oscillator crossovers and divergence to identify capability trend reversals.

7. Ichimoku Cloud:

The Ichimoku Cloud is a complete indicator that provides records about assist and resistance stages, trend direction, and momentum. It includes 5 traces: Tenkan-sen, Kijun-sen, Senkou Span A and B, and the Chikou Span. Traders analyze the interplay between those traces to make informed trading selections.

8. Average True Range (ATR):

ATR measures marketplace volatility through studying the common range between high and occasional charges over a unique duration. Traders use ATR to set stop-loss ranges, adjusting them primarily based at the cutting-edge marketplace situations. Higher ATR values imply improved volatility.

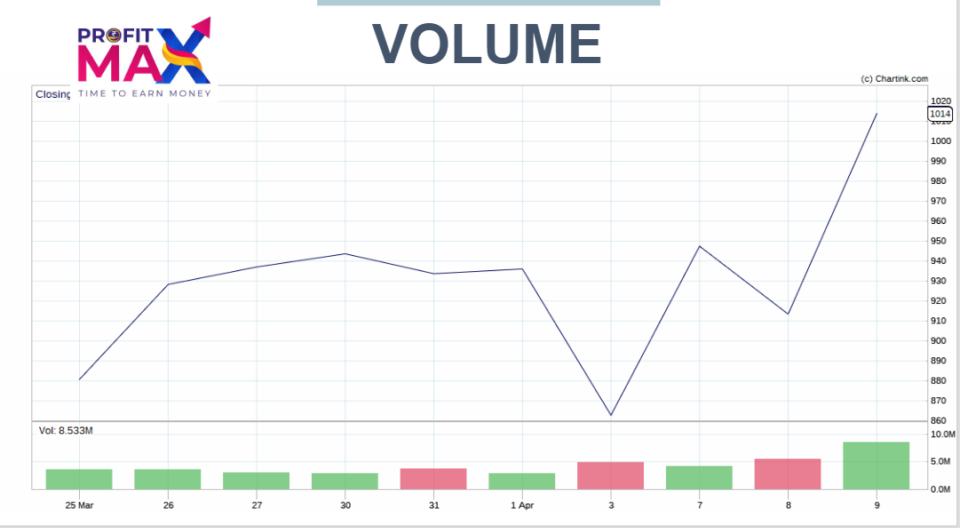

9. Volume:

While now not a standalone indicator, buying and selling quantity is a crucial element in technical analysis. Volume confirms the power of a fashion or indicators capacity reversals. Sudden spikes in quantity often precede tremendous rate actions, imparting valuable insights to investors.

10. Parabolic SAR:

The Parabolic SAR (Stop and Reverse) indicator enables become aware of capacity reversals inside the marketplace. It appears as dots above or under rate bars, indicating the route of the fashion. When the dots switch facets, it signals a ability reversal.

Conclusion:

Mastering the art of trading involves harnessing the strength of these signs of indicators in harmony with a well-described approach. While each indicator presents precise insights, combining them can offer a extra complete view of marketplace dynamics. which can be helpful for you to maximize your profit while trading in intraday or long term (Including buying, selling of Futures and Options).

It’s essential to understand the strengths and limitations of every indicator and adapt them on your trading fashion. As you embark on your trading adventure, keep in mind that indicators are equipment, and success lies in the considerate and disciplined software of those gear in ever-changing market situations.

While using these indicators you have to keep in mind which indicator will work efficiently on which Timeframe like some indicators works for long term trading however some indicators works for intraday and long term as well. In this case we have several tested strategies which works differently for intraday, and long term using these strategy you can observe the success ratio of 80% or more. you can reach out to us on +91-7722082020 | Email : info@profitmaxacademy.com

Moreover we provide consultation for absolutely free of cost its just a whatsapp away.

You can also follow us on social media for regular updates related to stock market.

Happy trading!